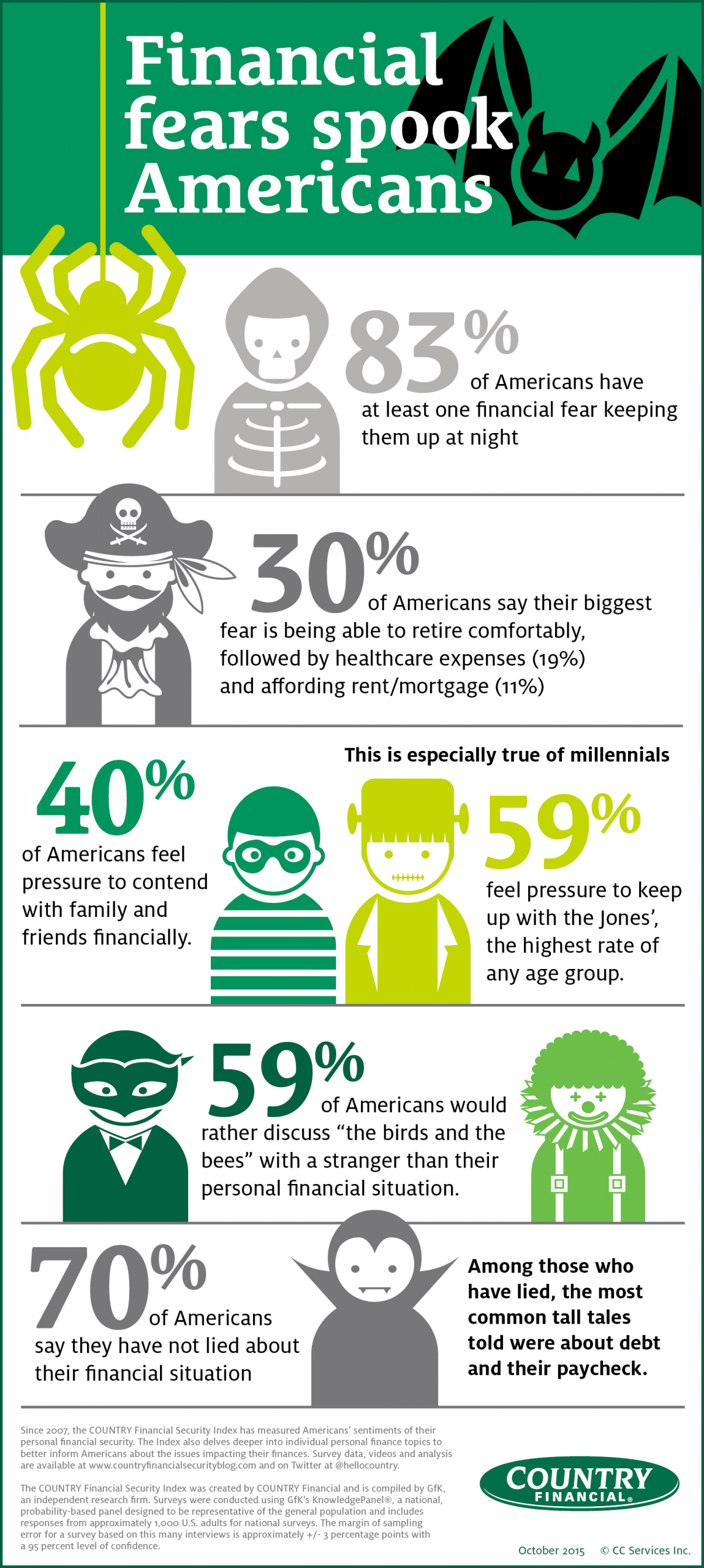

This Halloween, it’s not just Casper giving Americans a scare! Eighty-three percent of Americans have at least one financial fear keeping them up at night, according to the latest COUNTRY Financial Security Index.

What’s the spookiest of them all? Thirty percent of Americans say their biggest fear is being able to retire comfortably, followed by healthcare expenses (19 percent) and affording rent/mortgage (11 percent).

Money talk can be so scary that 59 percent of Americans would rather discuss “the birds and the bees” with a stranger than their personal financial situation (39 percent). This is especially true of women, as 63 percent share this preference compared to 55 percent of men.

Fears may change throughout our lives, but rarely disappear

While financial concerns may change, lessen or subside as one gets older, it seems they never go away completely. Forty-three percent of those 65+ say healthcare expenses are their greatest worry – topping affording rent or a mortgage and a child’s education.

On the other end of the spectrum, millennials concerns are more focused on job security and paying for housing, as well as being able to retire comfortably.

“As Americans meet financial goals throughout their lifetime, they have less financial hurdles to worry about,” says Joe Buhrmann, manager of financial security at COUNTRY Financial. “However, even at earlier stages in life, it’s important to take a long-term view and make sure to plan ahead for retirement and healthcare expenses, as these concerns become front of mind at older ages.”

“Americans of all ages may find a few ‘monsters in the closet’ or ‘goblins under the bed’,” says Joe Buhrmann, Manager of Financial Security at COUNTRY Financial. “Younger Americans may find themselves saddled with debt or job insecurity, and as we age, major concerns like retirement and healthcare expenses can take center stage. In any case, taking a long-term view and having a game plan can really provide a solid sense of security.”

The pressure of financial success

Nearly four in 10 (39 percent) Americans feel pressure to contend with family and friends financially. This is especially true of millennials – 59 percent feel pressure to keep up with the Jones’, the highest rate of any age group.

Despite financial fears, anxiety around discussing financial topics and pressure to keep up with family and friends, a majority of Americans (70 percent) say they have not lied about their financial situation.

Among those who have, the most common tall tales told were about debt and their paycheck. Forty-five percent of Americans who have lied said it was about their debt level, while 39 percent weren’t honest about how much money they make.

Lessening Financial Fears

If you happen to be one of the 83 percent of Americans who has anxieties about their finances, there are steps you can take to take control and lessen these fears. Some tips include:

Create a Budget: A budget is the foundation of any financial plan. Establishing spending guidelines can help you realize where your money is going and identify places to possibly lessen your expenses so affording necessities, like rent and healthcare, don’t have to be overwhelming.

Contribute to an Emergency Fund: An emergency fund should be among your top financial priorities. Start small and grow from there. An easy target might be to earmark your first 3-4% of income for your “rainy day fund.”

Start Saving Early: Retiring comfortably is the biggest financial fear for Americans and the best way to prepare is to contribute to a retirement account early. For example, set a goal to contribute a percentage of your paycheck to a retirement account. Make sure you take advantage of a company 401(k) match if it’s offered and personally increase your contribution rate each year.

———

Since 2007, the COUNTRY Financial Security Index has measured Americans’ sentiments of their personal financial security. The Index also delves deeper into individual personal finance topics to better inform Americans about the issues impacting their finances. Survey data, videos and analysis are available at www.countryfinancialsecurityblog.com and on Twitter at @hellocountry.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs